How to Resolve Secret Family Surety Contracts Through Unauthorized Agency and Apparent Authority

Table of Contents

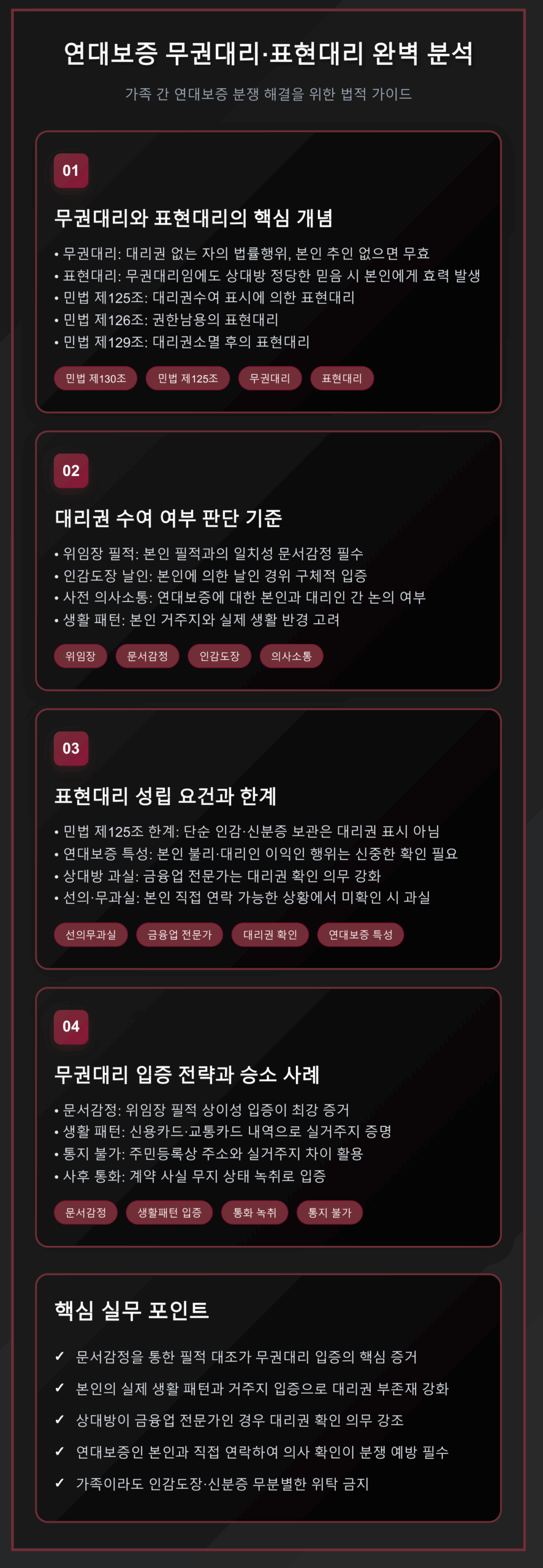

- 1. Legal Issues in Surety Agency Disputes

- 2. Understanding Unauthorized Agency and Apparent Authority Systems

- 3. Factors for Determining Agency Authority

- 4. Conditions and Limitations of Apparent Authority

- 5. Methods of Proving Unauthorized Agency Defense

- 6. Strategic Analysis Through Successful Cases

- 7. Prevention Measures for Surety Disputes

- 8. Comprehensive Summary

Related Video (Youtube)

1. Legal Issues in Surety Agency Disputes

Among financial disputes arising from family relationships, the most complex issue involves agency authority in surety arrangements. In situations where parents execute guarantee contracts under their adult children’s names, legal battles over whether genuine agency authority existed continue to emerge.

Surety contracts impose the same liability as primary debtors, representing significant legal acts. For such contracts to be executed by another party, clear and valid agency authority must be established beforehand.

In practice, family members frequently store each other’s seals and identification documents, then arbitrarily use them to complete guarantee contracts. The key determination becomes whether legitimate agency authority was granted or if this constitutes unauthorized agency.

2. Understanding Unauthorized Agency and Apparent Authority Systems

Concept of Unauthorized Agency

Unauthorized agency refers to situations where individuals without agency authority act on behalf of others in legal transactions. According to Article 130 of the Civil Code, unauthorized agency acts do not create legal effects for the principal unless ratified.

When unauthorized agency is established, contracting parties cannot demand performance from the principal and may only seek damages from the unauthorized agent.

Concept of Apparent Authority

Apparent authority is a legal doctrine that exceptionally attributes legal effects to the principal when contracting parties have reasonable grounds to believe agency authority exists, despite being unauthorized agency. The Civil Code recognizes three forms of apparent authority.

Article 125 of the Civil Code (Apparent Authority by Representation of Agency Grant): Those who represent granting agency authority to others bear responsibility for acts concluded with counterparties within that authority scope.

Article 126 of the Civil Code (Apparent Authority for Authority Abuse): When agents contract with counterparties within their authority scope, such acts remain effective for the principal except when counterparties knew or negligently failed to know about authority abuse.

Article 129 of the Civil Code (Apparent Authority After Agency Termination): When counterparties are unaware of agency termination without negligence, acts within pre-termination authority scope remain effective for the principal.

3. Factors for Determining Agency Authority

When determining whether agency authority for surety matters was actually granted, courts comprehensively review the following factors.

Formal Evidence of Agency Grant

The most crucial element is the existence of power of attorney documents directly prepared by the principal. However, the presence of such documents does not automatically establish agency authority, requiring careful examination of the following matters.

Whether the handwriting in power of attorney documents matches the principal’s handwriting serves as a key determination criterion. Confirming handwriting identity through document examination is paramount.

Whether seal impressions were made by the principal also constitutes an important consideration. Since family members frequently store seals before unauthorized use, the sealing process must be specifically proven.

Substantive Grounds for Agency Grant

Communication between the principal and agent also serves as an important determination criterion. Whether prior consultations occurred regarding surety arrangements as significant legal acts, and whether the principal was aware of them, must be confirmed.

The principal’s residential patterns and actual lifestyle are also considered. If the principal lived separately from the agent with poor communication, the possibility of agency grant becomes remote.

4. Conditions and Limitations of Apparent Authority

Even when unauthorized agency is established, responsibility may transfer to the principal through apparent authority theory, requiring detailed examination of apparent authority establishment conditions.

Limitations of Article 125 Apparent Authority

For agency grant representation to be recognized, the principal must have directly expressed agency authority. Simply entrusting seals or identification documents to family members cannot be viewed as agency grant representation.

Particularly for legal acts like surety arrangements that disadvantage principals while benefiting only agents, counterparties have duties to more carefully verify agency authority.

Counterparty Good Faith and Non-Negligence Requirements

For apparent authority to be established, counterparties must have reasonable grounds for trusting in agency authority existence. The following cases may establish counterparty negligence.

If counterparties work in financial industries, they must exercise greater care in confirming agency authority. Particularly those with credit information or lending experience should have been able to doubt agency authority authenticity.

If directly contacting principals to confirm surety intentions was not difficult, omitting this step may constitute negligence.

5. Methods of Proving Unauthorized Agency Defense

Parties claiming unauthorized agency must actively prove the absence of agency authority. Effective proof strategies include the following.

Handwriting Comparison Through Document Examination

Proving through document examination that handwriting in power of attorney or other documents differs from the principal’s handwriting provides the strongest evidence. When examination results show different handwriting, this strongly supports the absence of agency authority.

Proving Principal’s Lifestyle Patterns

Various evidence must prove that the principal lived separately from the agent with infrequent contact. Credit card usage records, transportation card usage records, and employment certificates can demonstrate the principal’s actual living radius.

Proving Inability to Receive Notifications

Proving that notarial deed preparation notifications were not actually delivered to the principal is also important. When registered addresses differ from actual residences, the inability to receive notifications must be emphasized.

Post-Event Phone Call Recordings

Phone recordings showing the principal’s unawareness of contracts after execution serve as very important evidence. If principals showed surprised reactions upon first hearing about contracts, this strongly supports the absence of agency authority.

6. Strategic Analysis Through Successful Cases

We will analyze success factors for unauthorized agency claims through actual cases won by K&P Law Firm.

Case Overview

This case involved defendant’s mother A borrowing 100 million won from the plaintiff while making her son (the defendant) a joint guarantor in a monetary loan notarial deed. A brought the defendant’s seal certificate, seal, resident registration card, and power of attorney to prepare the notarial deed.

Winning Strategy

K&P Law Firm proved the following facts through extensive evidence collection activities.

Document Examination Results: Document examination proved that handwriting in both the seal certificate issuance power of attorney and notarial deed preparation entrustment power of attorney differed from the defendant’s handwriting.

Lifestyle Pattern Analysis: Credit card usage records and other evidence proved that the defendant worked in Incheon with dormitory living, rarely visiting the family home in Gwacheon.

Phone Call Recordings: Recordings proved that approximately three months after notarial deed preparation, the defendant was completely unaware of the notarial deed preparation during phone calls with the plaintiff.

Counterparty Negligence: Despite the plaintiff being a financial industry professional with credit information company experience, they failed to directly confirm surety intentions with the defendant.

Court’s Judgment

The court comprehensively considered this evidence and made the following determination.

The court recognized that the defendant had not granted A agency authority for surety matters, and that A had unauthorized use of the defendant’s identification and seal.

The court determined that apparent authority was not established since the plaintiff lacked justifiable reasons for believing A possessed agency authority.

Consequently, the plaintiff’s claim was dismissed, relieving the defendant of surety responsibility.

7. Prevention Measures for Surety Disputes

To prevent disputes over surety agency authority, the following precautions must be observed.

Creditor Precautions

Directly contacting surety principals to confirm surety intentions is essential. Family agency should not be unconditionally trusted.

Power of attorney authenticity must be carefully examined, with document examination requested when necessary. Particular caution is required for high-value surety arrangements.

Special attention must be paid to verifying agency authority when conflicting interests exist between principals and agents.

Debtor and Guarantor Precautions

Even family members should not be carelessly entrusted with seals or identification documents. Particular caution is required with family members having financial problems.

Matters involving significant legal responsibilities like surety arrangements must be handled directly by principals.

Upon hearing that family members executed contracts under one’s name, immediate verification and legal action when necessary must be taken.

8. Comprehensive Summary

Surety agency authority disputes often arise from indiscriminate agency acts based on family trust. For unauthorized agency claims to succeed, thorough evidence collection and systematic legal construction are necessary.

Particularly, handwriting comparison through document examination, proving principal lifestyle patterns, and proving counterparty negligence become key success factors. Additionally, to prevent apparent authority establishment, counterparty negligence in agency authority verification must be actively argued.

K&P Law Firm recently won surety agency authority disputes through extensive evidence collection and systematic legal construction, successfully protecting client interests by comprehensively reviewing unauthorized agency and apparent authority doctrines.

About the Author